When you hear “business expense tracking,” what comes to mind? For a lot of Shopify sellers, it’s a dreaded task that involves a messy shoebox of receipts and a complex spreadsheet. But in reality, it's just about having a system to record and categorize every dollar your Shopify store spends to keep the lights on.

We're talking about everything from your monthly Shopify subscription and app fees to Meta ad spend, shipping supplies, and even that new laptop you bought specifically for your business. Getting a handle on this is the first real step to understanding if your Shopify store is actually profitable.

Why Smart Expense Tracking is a Game-Changer for Shopify Sellers

If you want to grow your Shopify store sustainably, you have to move beyond just looking at your sales numbers in the Shopify dashboard. Thinking of expense tracking as just a chore for tax season is a huge mistake. It’s actually one of your best strategic tools for e-commerce growth.

When you know your numbers inside and out, you can make smarter decisions about pricing, figure out which marketing channels are worth your money, and get a true pulse on the financial health of your business. Untracked costs are the silent profit killers in e-commerce, and they can bleed you dry without you even noticing.

These sneaky expenses can pop up everywhere in the Shopify ecosystem. It could be a small price hike from your dropshipping supplier, a forgotten monthly charge for a Shopify app you stopped using months ago, or even just the fluctuating shipping rates from Shopify Shipping. Without a solid system, these little costs add up and quietly eat away at your margins.

Uncovering the Hidden Profit Leaks

Let's imagine you're selling handmade jewelry on Shopify. You have a best-selling necklace that's getting tons of orders, but for some reason, your bank account isn't growing. It’s frustrating.

After digging into your expenses, you realize a key supplier jacked up the price of your silver clasps by 15% three months back. It was a small change you didn't even notice, but it was enough to turn your most popular product into a loss-leader. This happens all the time to Shopify merchants. It's a perfect example of a painful truth: you can't manage what you don't measure.

Your Shopify dashboard is great for a high-level overview, but it doesn't tell the whole story.

While you get a fantastic look at sales and orders, the admin panel can't automatically track every single external cost that comes with running your business. That part is up to you.

Shifting from Reactive to Proactive Financial Management

Once you get a good tracking system in place, you’ll feel a massive shift. You’ll go from putting out financial fires to proactively building a stronger business. You can finally answer the big questions with real data, not just a gut feeling.

- Which marketing channels are actually working? By tracking your ad spend on Meta, Google, or TikTok specifically for your Shopify store, you can calculate your true Customer Acquisition Cost (CAC) and see where your budget is best spent. For example, if you spend $500 on Meta Ads and get 10 new customers, your CAC for that channel is $50.

- Is my pricing profitable? When you account for inventory costs, packaging, Shopify Payments fees, and app subscriptions, you’ll know for sure if your prices are set right.

- Where can I cut costs without hurting the business? A clear expense log makes it easy to spot the dead weight, like that pricey Shopify app subscription you never use.

This kind of clarity is more important than ever, especially as operational costs continue to climb. For example, business travel costs are on the rise, which directly impacts merchants who attend trade shows or visit suppliers. To get a better handle on the basics, these small business expense tracking tips are a great starting point.

The real goal here is to turn your raw financial data into a roadmap for growth. Expense tracking shows you exactly where your money is going, so you can put it to better use and protect your profit margins from those subtle, creeping costs.

Building Your Shopify Expense Tracking Foundation

Before you can make sense of your numbers, you need a solid system for tracking your business expenses. For Shopify merchants, this starts with a smart, simple framework. Forget the complicated accounting jargon for a minute—just think in terms of the actual money leaving your business every day.

The whole point is to build a system you'll actually stick with. It doesn't matter if you're using a basic spreadsheet or a fancy app; the core principles are the same. You need to give every single expense a logical home so you can see exactly where your money is going.

Starting with Core Shopify Expense Categories

Let's get practical. Most of the expenses for any Shopify store fall into a few key buckets. Getting these categories set up from day one will save you a massive cleanup headache down the road.

You need to start by listing out the essentials. This goes way beyond your monthly Shopify plan; it’s every digital and physical cost that keeps your business running.

Here are the non-negotiable categories every Shopify store needs:

- Cost of Goods Sold (COGS): This is the direct cost of the products you sell. For example, if you sell t-shirts, this includes the cost of the blank shirt, the printing, and the shipping fee to get it to your fulfillment center.

- Platform & App Fees: Your monthly Shopify subscription lives here. But don't forget to include every single app fee—from Klaviyo for email to Loox for reviews. Those $9.99/month charges add up fast.

- Transaction Fees: Every sale has a cost. This category is for all payment processing fees from Shopify Payments, PayPal, Stripe, or any other gateway you use.

- Marketing & Advertising: This is where you track your ad spend on platforms like Meta (Facebook and Instagram), Google Ads, and TikTok. It also includes costs for things like influencer collaborations, affiliate payouts from apps like UpPromote, or PR services.

Creating specific, relevant categories is the single most important step you can take. A well-organized structure turns a messy pile of receipts into clear financial insights, showing you which parts of your business are actually making money.

To give you a clearer picture, here’s a breakdown of some essential expense categories you should have in your system.

Essential Expense Categories for Shopify Stores

| Category | Examples of Expenses | Why It's Important to Track |

|---|---|---|

Cost of Goods Sold (COGS) | Product inventory costs, raw materials, inbound shipping, manufacturing labor. | Directly impacts your gross profit margin; essential for pricing strategy. |

Platform & App Fees | Shopify subscription, app subscriptions (e.g., Klaviyo, Loox), theme purchases. | These are fixed operational costs you need to cover each month. |

Marketing & Advertising | Google Ads, Meta Ads, influencer payments, affiliate commissions, content creation. | Helps you calculate your Customer Acquisition Cost (CAC) and marketing ROI. |

Transaction & Processing Fees | Shopify Payments fees, PayPal fees, credit card processing fees. | A variable cost tied to every sale; often overlooked but can be significant. |

Shipping & Fulfillment | Packaging supplies (boxes, mailers), postage, fulfillment center fees (3PL). | Critical for understanding your true cost per order and setting shipping rates. |

Professional Services | Accountant, lawyer, consultant fees, freelance designer or developer costs. | Tracks your investment in expertise to grow and protect your business. |

Salaries & Contractor Pay | Employee wages, virtual assistant payments, freelance writer fees. | Your labor costs, a major operating expense for scaling businesses. |

Tracking these categories diligently will give you a powerful, at-a-glance view of your business's financial health.

Tracking Variable and One-Off Costs

Beyond the predictable monthly charges, you'll have plenty of other expenses that need a home. These might be variable costs that fluctuate with your sales volume or just random one-time purchases.

For instance, if you invest in custom branded mailers for the holidays, that’s a clear packaging expense. You'd pop that into a "Shipping & Packaging Supplies" category. Hire a photographer for a new product shoot? That could go under "Creative & Content."

Let’s walk through a real-world Shopify example. You just paid an invoice for an influencer who promoted your new product launch. Instead of letting that receipt get lost in your inbox, you immediately log it in your tracking system:

- Expense: Influencer Collaboration Fee

- Amount: $500

- Category: Marketing & Advertising

- Date: Today's Date

This simple act brings immediate clarity. Of course, while you're setting up this foundation, it pays to understand the bigger financial picture. Getting a handle on general accounting principles for e-commerce is a game-changer for long-term success.

Solid financial practices also go hand-in-hand with store security. A great expense system helps you spot weird charges, complementing the protection you get from a top-tier fraud protection app. By building this framework, you're not just tracking expenses—you’re creating a powerful tool for making smarter, more profitable business decisions.

Choosing the Right Expense Tracking App for Your Store

Alright, you've got your expense categories nailed down. So what's next? It's time to bring in a tool to automate the whole shebang. Spreadsheets are fine when you're just starting, but the real magic happens when you use a dedicated app that talks directly to your Shopify store. No more manual entry, just a clear, real-time picture of your finances.

The Shopify App Store is swimming with options, and honestly, the "best" one really depends on how you run your business. Are you a high-volume dropshipper juggling thousands of tiny transactions? Or a brand with a warehouse full of physical inventory? Each model has its own financial headaches, and there’s probably an app designed to solve your specific problem.

Holistic Accounting Platforms vs. Specialized Tools

When you start looking, you'll see two main flavors of apps: the big, all-in-one accounting platforms and the laser-focused e-commerce tools. Figuring out which one you need is the key to getting this right.

A holistic platform like QuickBooks Online is built to be the central command for your business finances. It does everything—invoicing, payroll, inventory, and deep-dive financial reports. Think of it as your entire finance department in a single piece of software.

On the other hand, you have specialized apps like A2X. These tools don't try to do everything. Instead, they solve a very specific e-commerce problem with incredible precision. A2X is a master at calculating your Cost of Goods Sold (COGS) and, more importantly, untangling the messy knot of transaction fees and sales data from each Shopify Payout.

Let's make this real with a Shopify-specific scenario.

Say you're a dropshipper struggling to make sense of thousands of individual transaction fees from Shopify Payments. A2X is your hero. It bundles all those transactions and sends clean, summarized journal entries to your accounting software. But if you're managing physical stock with Shopify Inventory, have a team on payroll, and need to send invoices, QuickBooks is the more complete solution.

Must-Have Features for Shopify Integration

No matter which path you take, there are a few features that are absolutely non-negotiable for any Shopify store owner. Make sure any tool you consider has these:

- Direct Bank Feed Integration: This is huge. It automatically pulls in every transaction from your business bank accounts and credit cards. Nothing gets missed.

- Receipt Scanning and Capture: Look for a mobile app that lets you snap a picture of a receipt for packaging supplies or inventory. The good ones will pull the data right off the image, saving you from hours of typing.

- Automatic Expense Categorization: The smartest apps learn your habits. They’ll see your monthly Shopify bill and automatically tag it as "Platform Fees" without you having to lift a finger.

These features are what build a truly hands-off system. Trying to track all this manually isn't just a time-sink; it's a recipe for mistakes that can cause major headaches down the road. In fact, a staggering 71% of finance leaders admit they struggle with expense compliance and fraud when they rely on manual systems. It’s clear that automation isn't just a nice-to-have anymore—it's essential for keeping your books clean. You can see more stats and trends on expense management at expenseout.com.

As you weigh your options, checking out a guide on the best accounting software for small businesses can be a huge help, since many of them have powerful expense tracking built-in. The goal isn't just to find something that tracks your spending today, but to find a partner that can grow with you and give you smarter insights as you scale.

How to Automate Your Expense Workflow

Having the right app is a good start, but the real magic happens when you build a hands-off business expense tracking system. Automation isn't just about speed; it's about creating a smart workflow that handles all the repetitive, soul-crushing tasks for you. This frees you up to focus on what actually matters—growing your Shopify store.

The goal is to stop being a data-entry clerk and let a system run quietly in the background. That means less time digging for receipts and more time making strategic decisions. When you automate properly, you slash errors and ensure your financial data is always accurate and ready for you.

Setting Up Smart Rules and Triggers

One of the quickest wins in automation is setting up 'rules' inside your accounting software. Think of them as simple "if-then" commands for your finances. You can teach the software how to categorize recurring expenses the moment they hit your bank account.

This is a game-changer for predictable costs in the Shopify ecosystem. For instance:

- Rule 1: If a transaction has "Shopify" in the description, automatically categorize it as "Platform & App Fees."

- Rule 2: If a charge is from "Klaviyo," file it under "Marketing Software."

- Rule 3: When you see a payment to "Uline," classify it as "Shipping & Packaging Supplies."

Just by setting up a few of these, you can wipe out 80% or more of your manual categorization work. It’s a tiny time investment that pays off every single month.

The Power of a Dedicated Business Card

Here's another pro tip for making reconciliation a breeze: use one dedicated business credit card for every single store-related purchase. No exceptions. When all your transactions—from Facebook Ads to inventory buys from your supplier—are on a single statement, the headache of separating business from personal spending vanishes completely.

This simple discipline keeps your books incredibly clean. As your bank feed syncs with your software, every expense is already pre-sorted, just waiting for your smart rules to kick in and do the rest of the work.

By combining a dedicated card with automated rules, you create a powerful, self-organizing system. This foundational setup is the key to building more advanced workflows that can completely transform how you manage your store's finances.

Advanced Automation with Shopify Flow and Zapier

Ready to really level up? Tools like Shopify Flow and Zapier are where you can build a truly hands-off expense management process by connecting all your different apps.

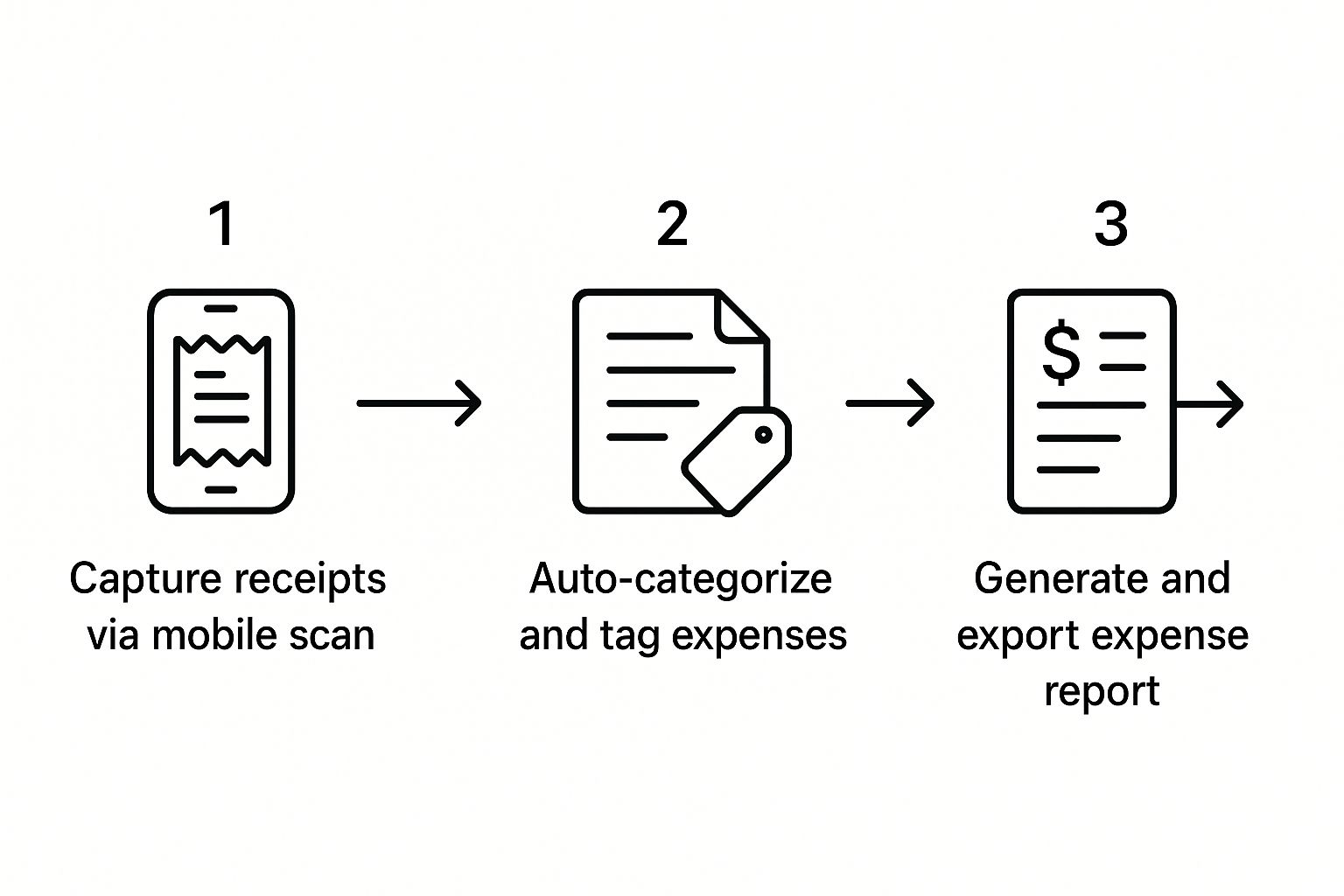

This visual shows the basic idea of an automated expense report, from the initial purchase all the way to the final export.

The diagram shows how data can flow through the system without anyone having to lift a finger. Let's look at a practical Shopify example you could set up in minutes:

Real-World Zapier Workflow:

- Trigger: A new charge from "Facebook Ads" appears on your dedicated business bank account.

- Action 1: Zapier instantly creates a new expense record in your QuickBooks account.

- Action 2: It then categorizes this expense under "Marketing & Advertising" and adds a "Facebook" tag for easy filtering.

With a single workflow like this, every dollar of your ad spend is tracked perfectly without you ever logging into your accounting software. This is what smart business expense tracking looks like for a modern Shopify seller.

Using Expense Data to Make Smarter Decisions

Tracking every dollar is a good start, but it's only half the battle. The real magic happens when you turn all that raw data into a strategic roadmap for your Shopify store.

Let’s be honest, business expense tracking isn’t just about having tidy books for your accountant. It's about generating insights that help you grow smarter, not just bigger. Once your expenses are flowing into an accounting tool that talks to Shopify, you unlock a whole new level of understanding through financial reports. These aren't just boring documents; they're your secret weapon for cutting waste and finding hidden profits.

Interpreting Your Profit and Loss Statement

If there's one report you need to get comfortable with, it's the Profit & Loss (P&L) statement. Think of it as your store's report card. It gives you a clean snapshot of your financial health over a certain period by subtracting all your expenses from your revenue.

For a Shopify merchant, the P&L pulls everything together. It shows you what it really costs to run your store, way beyond just the price of your products. Get in the habit of looking at it regularly, and you'll start to catch rising costs before they spiral out of control.

A P&L statement is more than a historical record; it's a diagnostic tool. It tells you a story about your business's health, highlighting what's working and, more importantly, what’s draining your profits.

Let's say you're looking at last quarter's P&L. You notice that your "Shipping & Packaging Supplies" category shot up by 30%, but your order volume only grew by 10%. That’s a massive red flag. It’s a clear signal to dig deeper—maybe it's time to renegotiate with your supplier or hunt for more cost-effective packaging.

Calculating Your True Customer Acquisition Cost

One of the most powerful things you can do with your expense data is figure out your true Customer Acquisition Cost (CAC). A lot of Shopify sellers make the mistake of only looking at their ad spend, but a real CAC includes every single marketing-related cost.

To nail this down for your Shopify store, you need to pull from a few different expense categories:

- Ad Spend: The obvious one—what you're paying platforms like Meta, Google, and TikTok.

- Marketing Tools: All those monthly subscriptions for email platforms (like Klaviyo), SEO tools (like SE Ranking), and any other apps you use.

- Creative Costs: Any money spent on photographers, designers, or content creators for your product pages and ads.

Add all of that up and divide it by the number of new customers you brought in during that time. That's your true CAC. This number is gold. It tells you exactly what it costs to get a new customer in the door, which means you can make much smarter bets with your marketing budget. This data-driven approach is a core part of solid cash flow management.

As your business scales, other costs creep in, like travel for trade shows or supplier visits. Globally, business travel is a massive expense category, expected to hit $1.57 trillion in 2025. You can see the latest global travel spending trends at GBTA.org. This just goes to show how vital it is to track every single expense to keep your budget in check. When you learn to turn data into insights, expense tracking stops being a chore and becomes your most valuable strategic tool.

Your Top Shopify Expense Tracking Questions, Answered

Even with a slick system in place, you're going to have questions about tracking your business expenses. It's just part of the game. For Shopify store owners, these questions usually pop up around the unique, day-to-day challenges of running an e-commerce business.

Let's be real—these aren't just abstract accounting problems. They're the practical hurdles that can mess with your profitability and compliance if you don't get them right. Let's tackle a few of the most common ones I hear.

How Should I Really Handle Shopify Payouts?

This is probably the biggest point of confusion for new store owners. You see that deposit from Shopify hit your bank account, and it feels like pure revenue. But it’s not.

That single payout is a mix of revenue from potentially dozens of orders, all mashed together with transaction fees, app charges, and maybe even a few refunds. Just logging it as a simple deposit gives you a totally skewed view of your finances.

The right way to do it is to never treat the payout as a lump sum of revenue. Instead, you need a tool that can break it down for you. An integrated accounting app like QuickBooks or A2X is perfect for this. They connect directly to Shopify and automatically dissect each payout into its individual parts:

- Gross Sales

- Shopify Payments Fees

- Shipping Income

- Sales Tax Collected

- Refunds Issued

This is the only way to get a truly accurate picture of your cash flow. It’s the difference between guessing where your money is going and knowing.

Can I Actually Claim My Home Office as an Expense?

Yes, you absolutely can! If you're running your Shopify empire from a spare room, you can often claim home office expenses. But—and this is a big but—you have to be careful.

The IRS is strict about this. The space must be used exclusively and regularly for your business. That means you can't claim your kitchen table if your family also eats dinner there. It has to be a dedicated workspace where you manage your Shopify store, pack orders, or do product photography.

You’ve got two ways to calculate the deduction: the simplified method (a flat rate per square foot) or the actual expense method. With the second option, you track a percentage of your real home expenses—like mortgage interest, rent, utilities, and insurance—based on your office's square footage relative to your home's total. It's always a good idea to chat with a tax professional to make sure you’re on the right side of the rules.

Don't sleep on legitimate deductions like a home office. These small, consistent write-offs can lead to some serious tax savings over the year. Just remember that meticulous record-keeping is non-negotiable.

Keeping your books clean doesn't just help with taxes; it's a huge boost for your store's security. It's way easier to spot a weird or fraudulent charge when your financials are organized. This kind of diligence goes hand-in-hand with smart security measures. For more on that, check out our guide on fraud protection for your Shopify store.

Stop losing money to chargebacks and protect your profits. Fraud Falcon offers automatic fraud prevention tailored for Shopify, allowing you to set custom rules and block fraudulent orders before they become a problem. Secure your revenue and streamline your operations with our 14-day free trial. Start protecting your store today.