Most Shopify owners think of chargebacks as just another refund. A minor inconvenience, the cost of doing business. But that's a dangerous misunderstanding. Each dispute is a multi-layered attack on your store’s bottom line, and ignoring them is like letting a silent killer roam free in your business.

Why Chargebacks Are a Silent Killer for Shopify Stores

Let's get one thing straight: a chargeback is not just the loss of the sale and the product. That’s only where the bleeding starts. The moment a dispute is filed, your payment processor—whether it's Shopify Payments or a third-party gateway—slaps you with a non-refundable dispute fee. This fee is typically anywhere from $15 to $25 per incident.

And the worst part? You pay this fee whether you win the dispute or not. Suddenly, that $50 product you sold isn't just a $50 loss. It’s a $75 hole in your revenue. These fees pile up fast, quietly eating away at your profit margins until there's nothing left.

The Hidden Costs Beyond the Sale

The financial sting doesn't stop there. Every single chargeback hijacks your time—your most valuable and non-refundable asset. Instead of focusing on marketing, product development, or talking to happy customers, you or your team are forced to stop everything to play detective. You're digging through records, gathering evidence, writing compelling arguments, and navigating the Shopify dashboard to submit it all. This can easily burn hours for a single dispute.

For every $100** lost to a chargeback, the true cost to you is closer to **$250 when you factor in fees, operational time, and the cost of the goods themselves.

Imagine this very real Shopify scenario: you run a gadget store and just launched a hot new drone. Sales are booming. Then, a few weeks later, the chargebacks start rolling in from your Shopify dashboard. It's a classic case of 'friendly fraud'—customers claiming their packages never arrived, even though the tracking numbers you uploaded to Shopify show they were delivered.

You're now facing a nightmare on multiple fronts:

- Lost Revenue: The full sale price for every drone is gone.

- Lost Inventory: The drones are out in the wild, impossible to resell.

- Dispute Fees: A $15 fee for every single chargeback filed against you.

- Wasted Hours: Your days are now consumed with compiling proof of shipment for dozens of different orders from within your Shopify Admin.

This is how a wildly successful product launch can quickly morph into a financial disaster.

To help you get started, here's a quick summary of the core strategies you can implement right now to start protecting your Shopify store.

Your Quick Guide to Reducing Shopify Chargebacks

| Strategy Area | Key Action for Shopify Stores |

|---|---|

Clear Communication | Use your Shopify theme's navigation and footer to prominently display your shipping, return, and refund policies. |

Customer Service | Install a live chat app or a help desk like Gorgias to make it easier for customers to contact you than their bank. |

Accurate Descriptions | Use high-quality images, variant swatches, and detailed descriptions on your Shopify product pages to set realistic expectations. |

Shipping & Tracking | Always use tracked shipping and ensure tracking numbers are automatically added to orders in Shopify and sent to customers. |

Fraud Prevention | Implement a fraud detection app like Fraud Falcon to automatically flag or block high-risk orders. |

These actions form the foundation of a strong defense, turning your store from an easy target into a well-protected business.

The Long-Term Threat to Your Business

Here’s the danger that can truly sink your store: damage to your merchant account. Payment processors are constantly monitoring your chargeback-to-transaction ratio. If this ratio creeps above their threshold—often a razor-thin 1%—you get flagged as a high-risk merchant.

This can trigger severe penalties. Think higher processing fees, a rolling reserve (where they hold a chunk of your money), or the ultimate punishment: outright account termination. Getting dropped by Shopify Payments can make it almost impossible to find another processor willing to take a chance on you.

With the global chargeback volume projected to hit a staggering 324 million transactions annually by 2028, this isn't a problem you can afford to ignore. You can dig deeper into the latest chargeback statistics and trends on chargeflow.io. Understanding this full spectrum of risk is the first, most critical step in protecting your business.

Building a Chargeback-Resistant Customer Experience

Let's be honest, the best way to deal with chargebacks is to stop them before they even start. A proactive strategy built around a clear, trustworthy customer experience is your single best defense. Most disputes don't begin with a scammer trying to rip you off; they start with simple confusion or frustration.

By focusing on total clarity at every single touchpoint, you can stamp out the root causes of common chargebacks long before a customer even thinks about calling their bank. This means turning your Shopify product pages, store policies, and customer communication into your most powerful prevention tools.

Set Crystal-Clear Expectations with Product Descriptions

One of the top reasons for a chargeback? “Product not as described.” This is the classic case of expectations not meeting reality. Your Shopify product pages are the first—and best—place to close that gap.

Don’t just sell; educate. Your descriptions need to be so detailed that there’s absolutely no room for misinterpretation. For a Shopify clothing store, that means going way beyond “blue cotton t-shirt.”

- Material Composition: Is it 100% Pima cotton, or a 60/40 cotton-poly blend? Use Shopify's built-in product fields or metafields to display this information clearly.

- Sizing and Fit: Ditch the generic S/M/L. Add a size chart app from the Shopify App Store or create a detailed size chart on a separate page and link to it from every product. Add context like, "Model is 6'1" and wearing a size Medium."

- High-Resolution Imagery: Utilize Shopify's support for multiple images and video. Show the product from every angle, with close-ups of texture and stitching. A short video showing the product in motion can be a total game-changer.

This level of detail ensures your customers know exactly what they’re getting, which massively cuts down on the post-purchase disappointment that fuels disputes.

Craft and Showcase Ironclad Store Policies

Hidden or confusing policies are practically an invitation for chargebacks. When customers can't quickly find answers about returns or shipping, their next call is often to their credit card company. You need to make your policies impossible to miss.

In your Shopify Admin, go to Settings > Policies and fill out the templates for your Return & Refund Policy and Shipping Policy. Then, ensure these pages are linked in your theme's main navigation and footer. Write them in plain, simple English. Ditch the legal jargon that nobody understands.

Key Takeaway: Make it significantly easier for a customer to get a refund from you than it is for them to file a chargeback with their bank. A straightforward, no-hassle return process, managed through a Shopify app like Loop Returns, is one of your most effective chargeback deflection tools.

Clear policies build trust and manage expectations from the get-go, giving customers a path to resolution that doesn't involve a messy dispute.

Communicate Proactively After the Purchase

The second a customer clicks "Buy," a little clock starts ticking in their head. Radio silence breeds anxiety and suspicion. You need to keep them in the loop every step of the way with automated—but still personal—email and SMS notifications from your Shopify admin.

Don't just stick with the default "Order Confirmed" email. Go to Settings > Notifications in your Shopify Admin and customize your templates to include:

- An itemized list of what they bought, complete with product images.

- A clear, realistic estimate of the delivery window.

- A direct link back to your shipping and return policies for easy reference.

As soon as the order ships, ensure your shipping integration (like Shopify Shipping) automatically triggers the "Your Order is on its Way!" notification. This email is critical. It must include the tracking number and a direct link to the carrier’s tracking page. This simple action provides proof of shipment and puts the customer in control, preventing a huge number of "product not received" claims.

This visual from Shopify's blog drives the point home: every interaction matters. Proactive communication is a crucial piece of the puzzle, reinforcing the trust you've built and making disputes far less likely. You can explore more strategies to improve customer experience and see how it directly boosts loyalty and reduces friction.

Make Your Billing Descriptor Unmistakable

Ever scanned your credit card statement and seen a charge from a company you don't recognize? That moment of "What is this?" is a major catalyst for chargebacks. If a customer doesn't recognize a charge, their first instinct is often to dispute it.

You can stop this dead in its tracks by customizing your billing descriptor in Shopify Payments. Go to Settings > Payments > Shopify Payments > Manage. Don't use your vague legal company name. Make it something your customers will instantly recognize.

- Good Example:

SP * DYNAMIC DRONES - Bad Example:

ACMEHOLDINGINC

Always include your store name. If you have space, adding a contact number or URL is even better. This small change is one of the quickest, most effective ways to eliminate "unrecognized transaction" chargebacks.

By mastering these foundational elements, you're not just creating a pleasant shopping experience—you're building a business that is inherently resistant to disputes. To dig even deeper, check out our comprehensive guide on how to prevent chargebacks for more advanced tactics.

Mastering Shopify's Native Fraud Analysis Tools

Your Shopify plan comes with a secret weapon that a surprising number of merchants either ignore or don’t fully grasp: the native Fraud Analysis tool.

This isn't some passive feature humming in the background. Think of it as an active intelligence system—your first line of defense against sketchy orders. Learning how to read its signals on each order page is one of the most direct ways you can slash chargebacks before they even have a chance to happen.

When an order pops up in your Shopify Admin, the platform automatically scans it for classic signs of fraud and slaps a color-coded risk level on it—low, medium, or high. It’s tempting to only sweat the high-risk ones, but the real power comes from digging into why an order was flagged in the first place.

This analysis hands you a set of clues right on the order page. Your job is to put on your detective hat and piece them together to tell the story of the transaction.

Decoding the Key Fraud Indicators

Shopify’s analysis isn't just a simple thumbs-up or thumbs-down. It’s looking at several different factors, and you need to know what they all mean to make a smart call. The most common indicators you'll see on the Shopify order page are AVS, CVV, and IP address verification.

- AVS (Address Verification System): This checks if the numbers in the customer's billing address (like the street number and ZIP code) match what the credit card company has on file. A mismatch is a major red flag. It often means the card is stolen, and the fraudster is trying to get the goods shipped somewhere else.

- CVV (Card Verification Value): You know this one—it’s the three or four-digit security code on the card. A failed CVV check means they typed it in wrong. Since this code isn't stored on the magnetic stripe or in most stolen card databases, getting it right is a pretty good sign that the person actually has the card in their hand.

- IP Geolocation: Shopify looks at the IP address where the order was placed and compares it to the billing and shipping addresses. Let’s say a customer in New York places an order to be shipped to Miami, but the billing address is in California. That’s highly suspicious. While a VPN could be the culprit, it’s usually a big warning sign.

My Pro Tip: Never, ever rely on a single indicator within Shopify's analysis. One mismatch could easily be an honest typo. But when you see multiple mismatches piling up on the order page? That’s when you’ve got a compelling story of potential fraud.

The Manual Review Playbook for High-Risk Orders

Let’s run through a classic Shopify scenario. An order for a $450 high-end jacket comes in. Bam—Shopify immediately flags it as high-risk. The knee-jerk reaction is to panic and cancel, but a quick, methodical manual review can often save a legitimate sale or confirm your worst fears.

First thing, open the order in your Shopify Admin and look at the fraud indicators. You see this:

- AVS ZIP code does not match.

- CVV check passed.

- IP address is from a different country than the billing address.

- Shipping address is different from the billing address.

This is a textbook example of a potentially bogus order. The passed CVV is a point in its favor, but it’s completely overshadowed by all the other mismatches. Now, it’s time to dig in.

Investigative Steps Before You Fulfill

Before you touch that "Fulfill" or "Cancel" button in your Shopify Admin, take these simple but incredibly powerful investigative steps. This is how you get the context you need to make the right decision.

- Map the Addresses: This is my go-to first move. Copy the shipping address from the Shopify order page and paste it into Google Maps. Pop open Street View. Is it a real house or an apartment building? Or does it look like a freight forwarder, a mail-forwarding service, or worse, a vacant lot? Fraudsters love using these kinds of drop points to get their hands on stolen goods.

- Analyze the Email Address: Take a hard look at the email on the order. Does it look like a real person’s address (e.g.,

john.smith1985@gmail.com), or is it just a jumble of random letters and numbers (hfkd739s@yahoo.com)? A nonsensical email is a huge tell that it's a throwaway account created just for fraud. - Attempt Customer Contact: This is a crucial one. Try calling the phone number they provided on the order. If it’s a real customer, they'll probably answer or call you back. If the number is disconnected or goes to a generic, un-setup voicemail, your suspicion should spike. You can also send a polite email asking them to confirm a few order details.

After running through this checklist, if the addresses look sketchy and you can't get ahold of the customer, the safest bet is to cancel and fully refund the order directly from the Shopify order page. Sure, you might lose one sale, but you’ll avoid a $450** chargeback plus a nasty **$15 dispute fee. This process gives you the confidence to trust the data and protect your bottom line.

While these native tools are a great start, they do require manual effort. For a more automated and layered approach, you can learn more about Shopify Payments' fraud protection capabilities and how they can be supercharged.

Choosing the Right Fraud Prevention App for Your Store

While Shopify's built-in fraud analysis is a decent first line of defense, it can leave you doing a lot of manual guesswork. When you're ready to get serious, automate your defenses, and layer on some real protection, the Shopify App Store is where you need to be.

Picking the right app isn’t about finding a magic bullet. It’s about matching the right tool to your store’s specific risk profile, your order volume, and, of course, your budget.

A good fraud app acts as a force multiplier. It automates the manual review process, catches sophisticated fraud that Shopify’s native tools might miss, and saves you countless hours staring at order details. This frees you up to actually grow your business, knowing your revenue is locked down.

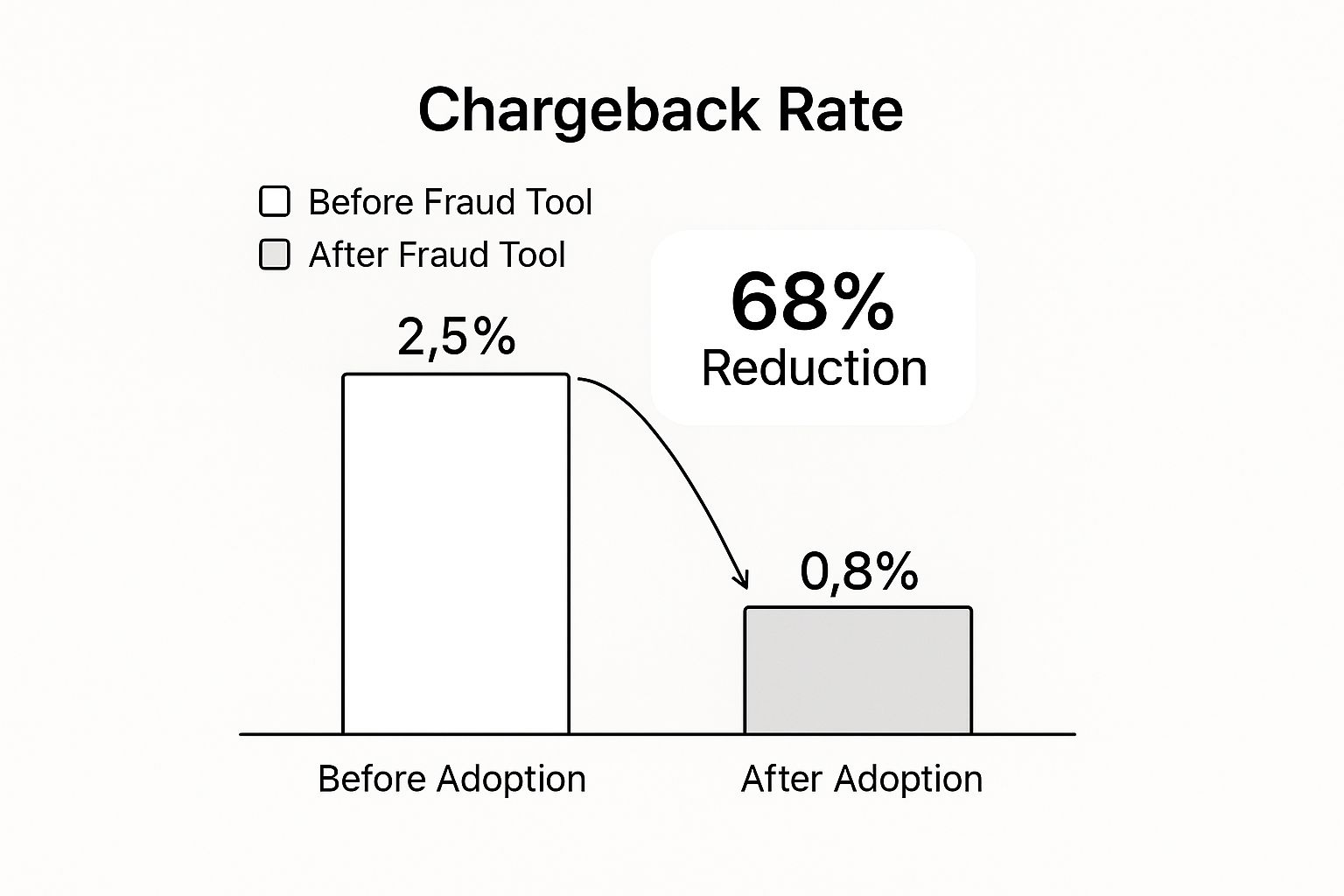

The difference a dedicated tool can make is pretty stark. Just look at the change in chargeback rates for a typical Shopify store before and after they installed a proper fraud prevention app.

As you can see, the right app doesn't just nudge your chargeback rate down—it can crush it by 68% or more. That’s real money saved and a much healthier relationship with Shopify Payments.

Finding the Right Fit for Your Business Model

Here’s the thing: different Shopify stores get hit with different kinds of fraud. A high-volume apparel store has a totally different set of problems than a business selling niche digital downloads. You have to understand your own vulnerabilities first.

For example, a Shopify store dropping high-end sneakers is a magnet for fraudsters with stolen credit cards. They need an app that crunches hundreds of data points and spits out a decision in milliseconds. For them, a chargeback guarantee model is often the perfect move. Apps like Signifyd or Riskified play in this space. They review your orders and, for a fee, take on the financial liability if an approved order turns out to be fraudulent. It’s incredible peace of mind, but it comes with a higher price tag.

On the other hand, a smaller Shopify store selling digital art might deal with "friendly fraud"—customers who download the product and then claim the charge was unauthorized. This shop doesn't need a full-blown insurance policy. They'd get way more value from a nimble, rule-based app like Fraud Falcon that integrates directly with Shopify Flow.

Key Insight: Don't pay for features you don't need. A smart, rule-based system that lets you automatically tag, hold, or cancel orders based on specific IP ranges or mismatched addresses might be all it takes to shut down your biggest fraud headaches.

This approach gives you surgical control without the hefty percentage-based fees of a guarantee model, making it a no-brainer for Shopify stores that have already spotted their own fraud patterns.

Comparing Top Shopify Fraud Prevention Apps

To help you get a clearer picture, it’s useful to see the main players in the Shopify ecosystem side-by-side. The app ecosystem basically breaks down into a few key approaches, each designed for a different type of merchant.

| App Name | Key Feature | Pricing Model | Best For |

|---|---|---|---|

Fraud Falcon | Customizable Rules Engine | Flat Monthly Fee | Shopify stores that want precise control to block specific, recurring fraud patterns without high transactional costs. |

Signifyd | Chargeback Guarantee | Percentage of Sales | High-volume or high-ticket Shopify stores that need full financial protection and are willing to pay for it. |

NoFraud | Hybrid Screening | Percentage of Sales | Shopify merchants looking for a mix of automated screening and expert manual review for flagged orders. |

Ultimately, the best choice boils down to whether you want to pay a premium for a hands-off insurance policy or prefer the control and cost-effectiveness of building your own targeted defenses within the Shopify ecosystem.

Taking Action with Customizable Rules

Let's walk through a real-world Shopify scenario. Imagine you run a store selling exclusive streetwear, and you keep getting fraudulent orders from a specific country. You notice they’re all being shipped to freight forwarders in Delaware.

Instead of playing whack-a-mole and manually canceling each one from your Shopify Admin, a rule-based app like Fraud Falcon lets you build a permanent solution.

You can set up a simple but powerful rule:

- Condition 1: If

Shipping Countryis[Problem Country]. - AND

- Condition 2: If

Shipping Addresscontains[Freight Forwarder's Street Name]. - Action: Automatically cancel the order and tag it as "Fraud Risk" in Shopify.

Boom. That one rule now works for you 24/7, blocking a known fraud pipeline without you lifting a finger. This is the kind of granular control that makes rule-based apps so effective for merchants who know their business inside and out. It's about building a smart, resilient defense that protects your hard-earned revenue.

Even with the best prevention strategies, a few chargebacks are bound to sneak through. When that dispute notification pops up in your Shopify dashboard, it’s easy to feel a sense of dread and just write it off as a cost of doing business.

Don't.

Treating every single dispute as a fight you can win is critical. It's not just about clawing back the money from one order; it's about signaling to payment processors that you're a diligent merchant who takes fraud seriously. Over time, this absolutely helps your account's standing. With the right evidence and a methodical game plan, you can seriously boost your win rate.

It’s also interesting to see how chargeback rates swing wildly depending on where your customers are. In 2023, for instance, Brazil had a whopping 3.48% chargeback rate, while Japan was down at just 0.18%. This kind of global context is great for risk assessment, but the fundamentals of a solid dispute response are the same no matter where the order came from. You can find more global chargeback rate comparisons on clearlypayments.com.

Gathering Your Compelling Evidence

The moment a chargeback is filed, the bank provisionally sides with its customer. Your job is to build such a compelling, evidence-backed case that you force them to reverse that decision. Shopify’s dispute interface makes submitting everything pretty easy, but it’s the quality of your evidence that will make or break your case.

Think of yourself as a detective building a file. You want to hand the bank an open-and-shut case with so much clear, undeniable proof that siding with their customer becomes impossible.

Here’s the core evidence you should pull together from your Shopify Admin for nearly every dispute:

- Proof of Delivery: For any "product not received" claim, this is your silver bullet. A carrier tracking number showing a "delivered" status to the customer’s address is the most powerful tool you have. Make sure you include a direct link to the tracking page.

- Customer Communications: Did you exchange emails with the customer? Screenshot everything. You can use an app like Shopify Inbox or a connected helpdesk to keep these records tidy.

- Store Policy Screenshots: You need to show the customer agreed to your terms. Grab clear screenshots of your return, refund, and shipping policies as they existed on your site when the purchase was made.

- Order and Fulfillment Details: Screenshots from your Shopify admin are essential. Capture the customer's IP address from the order, the billing and shipping addresses, and the exact date and time you fulfilled the order.

A Practical Walkthrough: "Product Not Received"

Let’s walk through a real-world Shopify scenario. A customer files a chargeback on a $120 order, claiming they never received it. You pull up your records in Shopify, and sure enough, the tracking information confirms it was delivered three weeks ago.

Simply throwing the tracking number at them isn't enough. You need to package your evidence professionally right inside Shopify's response form.

First, you’ll want to lead with a strong rebuttal letter. This is just a brief, professional summary of your case. State the chargeback reason code and immediately explain why it’s invalid. It’s fine to use a template, but always customize it with the customer's name, order number, and delivery date.

Next, start uploading your proof. The first thing they should see is a screenshot of the carrier's tracking page showing that "Delivered" status, the date, and the full address. Follow that up with a screenshot of the order details page from your Shopify admin, highlighting how the shipping address perfectly matches the delivery address.

Finally, add any extra details that strengthen your case. If you have the automated "Your order has shipped" email confirmation from Shopify, screenshot that too. It proves the customer was sent the tracking number and could have monitored the delivery themselves.

Key Takeaway: Make the bank's job as easy as possible. Tell a clear, logical story with your evidence right within the Shopify dispute interface. A messy, disorganized submission gets rejected, even when the facts are on your side.

By presenting a professional and evidence-packed response, you shift the narrative. It’s no longer their word against yours; it’s a matter of documented fact. This disciplined process is key to winning individual disputes and maintaining a healthy, secure Shopify store.

For an even deeper look at building a strong defense, our complete guide on fraud protection for Shopify shows how a proactive approach can stop these disputes before they even happen.

Fighting chargebacks one by one feels like a losing game. It’s all defense, no offense. If you really want to get ahead of them, you have to stop reacting and start predicting.

Think of it this way: your past disputes aren't just losses. They're a goldmine of data, packed with the exact clues you need to stop the next one before it happens. This is how you flip the script and turn chargeback management into a smart, proactive strategy.

Your own Shopify analytics dashboard is the perfect place to start this detective work. By digging into the details of past disputes, you can start to connect the dots and uncover patterns you’d otherwise miss. This isn't about needing a data science degree; it's about asking the right questions and letting the answers point you in the right direction.

This data-first approach lets you build a smarter, tougher defense that learns and adapts over time.

Uncovering Revealing Patterns in Your Chargeback History

First things first, export your chargeback data from Shopify and start looking for common threads. Are most of your disputes coming from one place? Or maybe they're all tied to a single product?

Here are the key questions I always start with:

- Which products get hit the most? If one product has a crazy-high dispute rate, something’s up. It could be a misleading description, a quality control problem, or just a magnet for "friendly fraud." For instance, if a specific gadget is always getting hit with "not as described" claims, it's probably time to add a video to the product page showing its exact size and how it works.

- What are the most common reason codes? Getting buried in "product not received" disputes? That’s a huge red flag for your shipping process. In Shopify, check if you are automatically sending tracking info to customers. Maybe it's time to switch to a carrier with more reliable delivery confirmation.

- Do chargebacks spike after certain events? A wave of disputes right after a huge flash sale often means the team was too swamped to vet orders properly, letting high-risk ones slip through the cracks. Consider using an app that can automatically put orders on hold during high-volume periods.

By finding the root cause of your disputes, you stop just putting out individual fires. You're actually fixing the source of the problem, and that's the only way to make a real, lasting dent in your chargeback rate.

Using Regional Data to Sharpen Your Defenses

Your geographic data can also tell a compelling story. While you should almost never block an entire country without rock-solid evidence, looking at regional trends can help you fine-tune your fraud rules.

For example, recent analysis showed that while regions like CEEMEA accounted for only 0.03% of global chargeback volume, North America was a much higher-risk area simply due to the massive number of transactions. What's really interesting is that nearly 96% of countries actually saw their chargeback ratios decrease as merchants got better at handling the e-commerce boom. You can explore more about these chargeback rate statistics to see how your own trends stack up.

If you spot a recurring pattern of fraud coming from a specific city or region in your Shopify orders, you can take precise, surgical action instead of using a sledgehammer.

Turning Insights into Automated Action

This is where all that digging pays off. Once you've identified a clear pattern, you can use a fraud prevention app like Fraud Falcon to build an automated rule that stops it cold.

Let’s run through a real-world Shopify scenario. Say your data shows a spike in fraudulent orders for expensive items being shipped to freight forwarders in Florida. Instead of playing whack-a-mole and canceling these manually every time, you can create a simple rule:

- IF an order’s value is over $300

- AND the shipping address is in Florida

- AND the address has keywords like "freight" or "logistics"

- THEN automatically hold fulfillment and tag the order for a manual review in Shopify.

See what that does? The rule doesn’t block every order from Florida. It just flags the ones that fit the specific, data-backed fraud profile you discovered. This is how you transform chargeback management from a reactive headache into a smart, proactive system that protects your bottom line 24/7.

Frequently Asked Questions About Shopify Chargebacks

When you're dealing with disputes day in and day out, a lot of the same questions tend to pop up. Let’s get you some quick, no-nonsense answers to the most common chargeback questions Shopify merchants ask.

What Is a Normal Chargeback Rate?

This is the big one, isn't it? While it can shift a bit depending on your industry, the general rule of thumb is to keep your chargeback rate below 1%.

Most payment processors, Shopify Payments included, see anything over that 1% mark as a red flag. If your store stays above that line for too long, you could get hit with higher fees, be forced into a monitoring program, or even risk having your account shut down.

A smart, sustainable target for most Shopify stores is to aim for a rate well under 0.9%. It gives you a healthy buffer and keeps your business in good standing.

Can I Completely Eliminate Chargebacks?

I wish I could say yes, but realistically, the answer is no. Getting to a true 0% chargeback rate is nearly impossible for any Shopify store.

The biggest reason is something called "friendly fraud," where a legitimate customer disputes a charge they actually made—either by mistake, because they don't recognize it, or unfortunately, with bad intentions. No matter how buttoned-up your process is, some of these will inevitably get through.

The real goal isn’t to hit zero. It's to build a smart system for reduction and management. Focus on strong prevention using Shopify's tools and apps, and sharp detection to get your chargeback rate down to a manageable level that doesn't put your business at risk.

Is It Always Worth Fighting a Chargeback?

Not every single one, no. You have to do a quick mental calculation: is the juice worth the squeeze?

Take a low-value order, say $15**, where your proof is a bit shaky. Maybe you used Shopify Shipping's cheapest option without tracking to save a few bucks. The time and energy you'd spend gathering evidence and submitting the response could easily be worth more than the **$15 you might get back. In cases like that, sometimes it's better to just take the L and move on.

However—and this is a big "however"—you absolutely should fight fraudulent chargebacks when you have solid evidence. When you consistently push back against clear fraud through the Shopify dispute center, you're sending a message to banks and payment processors that you're a diligent merchant. Over time, this can actually improve your store's reputation and make fraudsters think twice before trying again.

Ready to stop guessing and start blocking fraud? Fraud Falcon empowers you to create custom, automated rules that shut down fraudsters before they can strike, protecting your revenue 24/7. Install Fraud Falcon today and take back control of your Shopify store's security.