When we talk about Shopify chargeback protection, we're talking about a store's first line of defense against payment disputes. Think of it as a security system for your revenue. Its job is to spot and prevent shady transactions from ever going through, and to give you the tools you need to fight illegitimate refund demands when they do pop up.

Without a solid plan, you're not just risking lost sales. You're opening yourself up to punishing fees and even the risk of your payment processor shutting you down.

What a Chargeback Really Means on Shopify

For anyone running a Shopify store, a chargeback is a whole different beast than a simple return.

Imagine this: a customer buys a pair of sneakers from your Shopify store. A week later, instead of using your return portal, they call their credit card company and claim the charge was unauthorized. That's a chargeback. Suddenly, the money is pulled from your Shopify Payments account, you're out the sneakers, and Shopify slaps you with a penalty fee for your troubles.

And this isn't some rare, fringe event. A staggering 60% of buyers now go straight to their bank instead of trying to work things out with the merchant first. This is fueled by a massive problem called "friendly fraud," where actual customers dispute perfectly valid charges. This type of fraud is a silent killer for ecommerce businesses, costing merchants an estimated $40 billion across the globe every year.

The Real Cost of Just One Chargeback

The sting of a chargeback isn't just about losing the money from that one sale. It’s a snowball effect of losses that can seriously damage your bottom line.

For every single chargeback filed against your store, you lose:

- The Sale Revenue: The original payment is yanked right out of your account.

- The Product: Good luck getting that back. The customer almost always keeps it.

- The Transaction Fee: The credit card processing fee you paid is gone for good.

- The Chargeback Fee: Payment processors, including Shopify Payments, hit you with a separate penalty (usually around $15 in the US) for every dispute—and you pay this fee whether you win or lose.

When you add it all up, a single $100 chargeback can easily end up costing your business over $120. A profitable sale instantly becomes a net loss.

It's About More Than Just the Money

The fallout from chargebacks goes way beyond the immediate financial hit.

Payment networks like Visa and Mastercard are always watching. They track every merchant's "chargeback rate"—the percentage of your total transactions that result in a chargeback.

If your chargeback rate gets too high, payment processors see you as a risky business. Cross their threshold—which can be as low as 0.3% on Shopify—and you’re in for a world of hurt. We’re talking about having your payouts frozen, getting hit with higher processing fees, or even losing your ability to accept credit cards entirely.

To even begin building a defense, you need to understand a comprehensive definition of a chargeback. That knowledge is the bedrock. Protecting your Shopify store isn't just about winning a dispute here and there; it's about keeping your business in good financial standing and making sure you're around for the long haul.

Using Shopify's Built-In Fraud Analysis Tools

Before you even look at third-party apps, you absolutely have to get comfortable with the powerful, free tools Shopify already gives you. Think of the native Fraud Analysis feature as your own built-in detective. It automatically flags sketchy orders, giving you a chance to investigate before you ship.

This feature is your first line of defense, providing essential Shopify chargeback protection without costing you an extra dime.

Shopify’s system isn't just winging it. It uses machine learning algorithms trained on millions of transactions across the entire platform. It looks at every order that comes through your store and slaps a risk level on it—low, medium, or high. This gives you an instant signal to either ship with confidence or hit the brakes and take a closer look.

The system is constantly looking for specific red flags that scream "fraud." Learning to read these signals is how you stop chargebacks in their tracks.

Decoding the Risk Levels

Shopify keeps it simple with a color-coded system: green for low, yellow for medium, and red for high. But what do these actually mean for you day-to-day?

- Low Risk (Green): These are the orders you love to see. For example, a returning customer buys a t-shirt, shipping it to the same address they've used before. The billing and shipping addresses match, the IP location makes sense, and the AVS/CVV checks came back clean. Ship it.

- Medium Risk (Yellow): This is your cue to do a little digging. A practical example: a customer orders a $300 watch. The billing address is in New York, but the shipping address is in California. This could be a gift, or it could be fraud. It’s worth checking the other indicators before fulfilling.

- High Risk (Red): Stop. Do not ship. A high-risk order typically has several major red flags. Fulfilling one of these without digging deeper is basically asking for a chargeback.

The trick is to use this system as a guide, not a final decision. A medium-risk order could just be a legit customer on vacation, while a sophisticated fraudster might find a way to make an order look low-risk.

Practical Examples of High-Risk Indicators

Let's walk through a real-world Shopify scenario. An order pops up for three expensive gaming headsets, totaling $750. The shipping address is in Miami, Florida, but the IP address used to place the order is traced back to Romania. That’s a massive geographical disconnect.

On top of that, the customer tried three different credit cards before one finally went through. Shopify’s Fraud Analysis puts these pieces together and immediately flags the order as high-risk. Shipping this out the door would be a huge gamble.

Here’s what that analysis looks like right inside a Shopify order:

You can see it plain as day. The screenshot highlights the high-risk indicators, from multiple payment attempts to the mismatch between the card's country and the customer's location. This gives you everything you need to act and prevent a guaranteed chargeback.

Key Data Points to Analyze

When a medium or high-risk order lands in your queue, you need to know exactly what to look for. Shopify’s Fraud Analysis section lays it all out for you.

The two most critical checks are the Address Verification System (AVS) and the Card Verification Value (CVV). AVS checks if the billing address matches what the credit card company has on file, while the CVV check confirms the customer actually has the card. If either of these fails, it's a huge red flag.

Here are the specific indicators you should always zero in on within your Shopify order details:

- AVS Check: You're looking for a "match." If it says "no match" or "unavailable," be extremely cautious. For example, an order where the street address matches but the postal code doesn't is a classic yellow flag.

- CVV Check: Again, you want to see a "match." A "failed" check means they typed in the wrong three or four-digit code from the back of the card. This is a common sign of a fraudster using a stolen card number without the physical card.

- IP Geolocation: Does the customer's IP address make sense? If their billing and shipping addresses are in New York, an IP address from New York is totally normal. An IP from another country? Not so much.

- Number of Payment Attempts: More than two or three failed attempts often means a fraudster is just cycling through a list of stolen card numbers, hoping one will stick. Shopify shows you this history right on the order page.

By making a habit of reviewing these built-in indicators on every flagged order, you can use Shopify's native tools to filter out the most obvious fraud. It's a simple process that can drastically cut your chargeback rate and protect your bottom line.

How Shopify Payments Actively Fights Fraud

Shopify Payments isn't just a simple way to take people's money; it's an active security partner working around the clock, right out of the box. While the native Fraud Analysis tool gives you clues to spot trouble yourself, Shopify Payments is far more direct. It uses some seriously smart tech to stop bogus transactions dead in their tracks—before they ever have a chance to become a chargeback headache.

This built-in, proactive layer of shopify chargeback protection is honestly one of the biggest reasons to use their integrated payment solution. It just works, adding a powerful shield to your store without you having to lift a finger.

Introducing 3D Secure Authentication

So, how does it do this? At the heart of it all is a technology called 3D Secure (3DS).

Think of it like two-factor authentication, but for credit card purchases. It’s an extra step during checkout where the customer’s own bank steps in to verify it's really them.

You’ve probably seen it yourself within the Shopify checkout flow. A customer with a 3DS-enabled card goes to buy something, and their bank might ping them with a one-time code on their phone. Or maybe they have to quickly approve the purchase in their banking app. This quick check confirms the person holding the card is the actual owner.

Here's the best part: when a transaction gets the green light from 3D Secure, the liability for any fraudulent chargeback that might pop up later shifts.

This is a huge deal for store owners. If a 3DS-verified order turns out to be fraudulent and leads to a chargeback, the financial hit usually lands on the card-issuing bank—not you. Your revenue is safe.

Smart Application Through Machine Learning

Now, you might be thinking, "Won't this annoy all my customers?" Forcing every single person through an extra verification step would definitely cause some friction and probably lose you some sales.

This is where Shopify gets clever. Instead of a blanket approach, Shopify Payments uses sophisticated machine learning to be selective. It only triggers this extra check for transactions that look genuinely suspicious.

The algorithms analyze tons of data points in real time to sniff out high-risk orders. Your legitimate, low-risk customers sail right through checkout without a hitch. Potential fraudsters, on the other hand, get stopped by the 3DS challenge. It's the perfect balance of maximizing security without sacrificing sales.

And it really works. By pairing machine learning with 3D Secure, Shopify Payments cut fraudulent chargebacks by a massive 20%. Even better, they did it while actually increasing payment success rates. It’s proof that tighter security doesn’t have to mean a clunky customer experience.

How 3D Secure Protects Your Store

Let's walk through a real-world example within the Shopify ecosystem. Imagine an order comes in for a brand-new, expensive laptop, and it has a few red flags—just like the ones we talked about earlier.

- The customer's IP address is in another country, thousands of miles from the shipping address.

- They fumbled the payment, trying a few different cards before one finally went through.

- The order is for a high-value item that’s easy to resell.

Instead of just flagging this for you to review later, Shopify Payments automatically triggers a 3D Secure challenge. The customer is prompted by their bank to verify who they are.

A legitimate buyer will complete this step in seconds. A crook with stolen card details? They're stuck. They can't provide the verification, and the transaction is blocked before it's even completed. This all happens automatically, protecting your store without you having to jump in every time.

For an even deeper look, you might want to check out our guide on Shopify Payments fraud protection features.

When to Add a Third-Party Protection App

Shopify's built-in fraud tools are a great first line of defense. But they’re not a silver bullet. As your store scales or if you're in a high-risk industry, you'll eventually hit a wall where manual reviews become a bottleneck and the native tools just can't keep up.

This is the exact moment a dedicated Shopify chargeback protection app goes from a "nice-to-have" to a must-have for survival.

Think of Shopify’s native tools as a good lock on your front door. It’ll stop the casual opportunist. But a dedicated app like Fraud Falcon is like installing a complete security system—one with automated monitoring, alarms, and a direct line to a response team. It’s a proactive strategy for a much more serious threat.

Recognizing when you've outgrown the basics is the key to protecting your revenue and securing your store's future.

Identifying the Tipping Point

Certain signs are clear indicators that it's time to upgrade your protection. If any of these sound familiar, the cost of a specialized app is almost certainly less than what you stand to lose from fraud.

- You're in a High-Risk Industry: Selling digital goods (like e-books or software licenses), gift cards, or high-end electronics on Shopify? You're a magnet for fraudsters. These niches naturally see higher chargeback rates, making advanced protection non-negotiable.

- Your Growth is Overwhelming You: When your Black Friday sales explode from 50 orders a day to 500, manually checking every medium-risk order is impossible. You end up either rubber-stamping potentially bad orders to keep up or delaying legit ones, which hurts the customer experience.

- You've Already Gotten Chargeback Warnings: If your chargeback rate is creeping up toward Shopify's threshold (often around 0.3%), you're in the danger zone. Pushing forward without reinforcements is asking to get your payment processing shut down.

- Your Team is Drowning in Fraud Review: Are you or your staff sinking hours each week playing detective on suspicious orders instead of growing the business? That's a huge red flag. The cost of that lost time alone can justify an app's subscription fee.

The Power of Automation and Guarantees

This is where leading Shopify apps completely change the game. Instead of just giving you data to sort through, they take direct action based on custom rules you set up. You instantly shift from a reactive, defensive posture to a proactive one.

A practical Shopify example: you could set a rule in an app like Fraud Falcon to automatically cancel any order where the billing country is different from the shipping country and the order total is over $500. This handles high-risk international orders instantly, without any manual work.

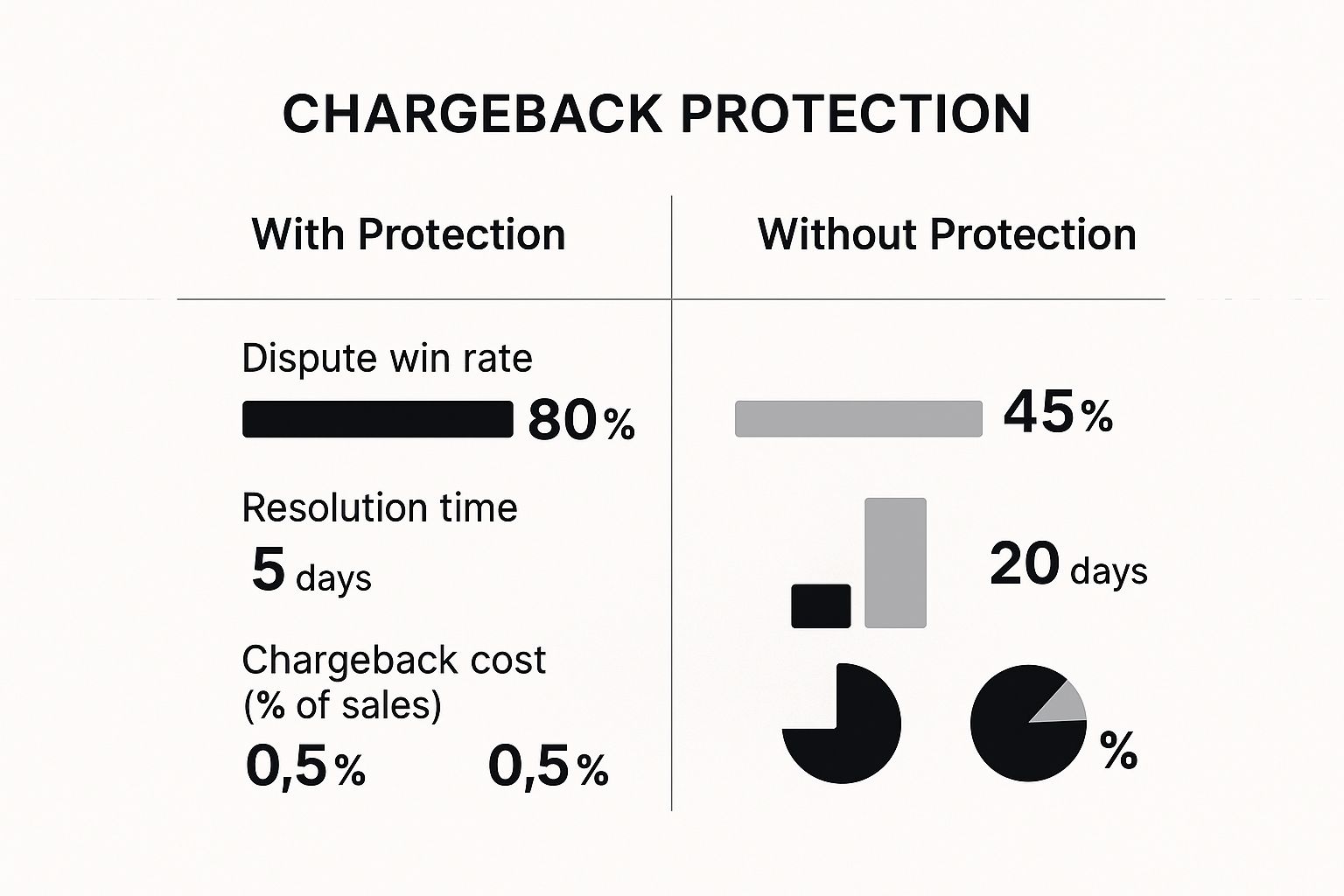

This infographic lays out the dramatic difference dedicated protection can make.

The numbers speak for themselves. Stores with specialized protection see much higher dispute win rates, faster resolutions, and a significantly smaller financial hit from chargebacks.

Shopify's built-in tools are a fantastic starting point for new and smaller stores. But as you grow, the limitations can become a real liability. This table breaks down when it's time to look beyond the native features and bring in a specialist.

Native Shopify Tools vs Third-Party Apps

| Feature | Shopify Fraud Analysis | Third-Party Apps (e.g., Fraud Falcon) |

|---|---|---|

Analysis Level | Basic risk indicators (IP, AVS, CVV) | Deep analysis (device fingerprinting, behavioral data, network history) |

Response | Manual review and decision-making | Automated actions (cancel, hold, tag) based on custom rules |

Financial Risk | You bear the full cost of any fraudulent chargeback | Often includes a financial guarantee, covering costs on approved orders |

Time Investment | High; requires manual investigation for medium/high-risk orders | Low; automation handles the bulk of the work |

Best For | New stores, low-risk industries, and low order volume | Growing stores, high-risk industries, and high order volume |

Ultimately, third-party apps aren't just about blocking fraud—they're about enabling growth. They give you the confidence to approve more orders and focus on your business, knowing a powerful safety net is in place.

Turning the Tables with Advanced AI

The financial stakes here are huge. Global chargebacks are on track to cost merchants a staggering $33.79 billion by 2025. What’s even crazier is that "friendly fraud"—where a real customer disputes a legitimate charge—makes up nearly 75% of all cases.

Advanced apps use AI to fight back. Some platforms help merchants recover up to four times more in chargebacks and prevent up to 90% of disputes before they even happen. If you want to dive deeper into the numbers, you can discover more insights about chargeback statistics on Chargeflow.io.

The best third-party apps go beyond simple rules. They use advanced AI and machine learning, trained on vast networks of transaction data, to identify complex fraud patterns that Shopify's native tools might miss.

These systems analyze hundreds of data points in a split second—things like device fingerprinting, behavioral analytics, and historical data—to make a hyper-accurate call. Some apps even offer a financial guarantee, promising to cover the cost if an approved order turns out to be a fraudulent chargeback. This takes the financial risk completely off your plate, letting you approve more orders with confidence and get back to what you do best: selling.

Operational Best Practices to Prevent Chargebacks

While a powerful fraud detection app is a fantastic shield, it’s only half the battle. The best Shopify chargeback protection strategies pair great technology with smart, consistent operational habits. These are the day-to-day things you do that stop disputes from ever happening.

Think of it like this: technology is your high-tech alarm system, but your daily habits are the simple act of locking your doors and windows. By tightening up your store's processes, you can stamp out the common frustrations and misunderstandings that cause customers to file a chargeback in the first place.

Here are the practical steps you can take today to build a much more resilient business.

Create Radically Clear Product Descriptions

One of the top reasons for a chargeback is "product not as described." It happens when a customer's expectation, which you set on your product page, doesn't line up with what they unbox. The fix is surprisingly simple: leave absolutely no room for interpretation.

Your mission is to paint such a vivid picture that the customer knows exactly what they're getting. This goes way beyond just a bulleted list of features.

- Use High-Quality Imagery and Video: Show the product from every conceivable angle. Include photos that give a sense of scale, close-ups that show the texture of materials, and even a quick video of the product being used. If you sell apparel, use a Shopify app like "Kiwi Sizing" to add a detailed size chart.

- Provide Exact Specifications: Don’t just say "large bag." Give the precise dimensions (e.g., 18" H x 12" W x 6" D), weight, materials used, and where it was made. If something needs to be assembled, say so loud and clear.

- Be Honest About Limitations: Does the color look a little different in sunlight versus indoor light? Does the product have a unique quirk? Pointing these things out builds trust and heads off disappointment at the pass.

Adding this level of detail to your Shopify product pages is easy. Just use the built-in editor to add image galleries and embed videos. It's a small investment of your time that can prevent some very costly disputes.

Always Use Tracked Shipping

The "product not received" chargeback is another huge headache for merchants. If you can't prove a package was delivered to the right address, it becomes your word against the customer's. And guess who the credit card companies almost always believe? The customer.

Using a shipping service that provides tracking isn't optional—it's essential. It gives you undeniable proof that you held up your end of the deal.

A tracking number is your single most powerful piece of evidence in a delivery dispute. When you can show a delivery confirmation scan at the customer's address, you dramatically improve your odds of winning the chargeback.

This is dead simple to do in Shopify. When you fulfill an order (either manually or through an app), just plug in the tracking number from your carrier (like USPS, FedEx, or UPS). Shopify automatically attaches it to the order and fires off a notification to the customer, which they love because they can watch their package's journey.

Offer Proactive and Responsive Customer Service

A surprising number of chargebacks are just the result of bad communication. A customer has an issue, they can't get a hold of you, they get frustrated, and they call their bank because they feel like it's their only option. A fast, helpful, and easy-to-reach customer service team is one of the best chargeback prevention tools you have.

Proactive communication is key. Using advanced customer order management platforms can make these interactions much smoother, cutting down on the kind of disputes that turn into chargebacks. Your goal is to solve their problem long before they even think about calling their bank. For more on this, check out our guide on how to prevent credit card fraud, where we dive into communication tactics.

Here’s how to turn your support into a chargeback-fighting machine:

- Make Contact Info Obvious: Don’t make people hunt for your email, phone number, or live chat. Use an app like "Shopify Inbox" for free live chat and put contact details in your store’s header, footer, and on the order confirmation page.

- Respond Quickly: Get back to customers within a few hours. Even an automated reply that says "We got your message and will be back with you shortly" can cool down a heated situation. A fast response shows you care.

- Empower Your Team: Give your support reps the power to actually solve problems. Let them issue a partial refund, send a replacement, or offer store credit directly within Shopify. A $10** refund is always, always cheaper than a **$100 chargeback.

By focusing on these three pillars—crystal-clear descriptions, tracked shipping, and amazing support—you create a business where chargebacks simply can't find a foothold. You'll protect your revenue and build a base of customers who actually like you.

Got Questions About Shopify Chargebacks? Let’s Clear Things Up.

Diving into the world of payment disputes can feel like you’re trying to learn a whole new language. To cut through the confusion, I’m going to break down some of the most common questions Shopify merchants have about chargebacks. My goal is to give you the clarity you need to actually protect your store.

What Is The Difference Between Fraud and Chargeback Protection

People often use these terms interchangeably, but they are absolutely not the same thing. They tackle two completely different stages of a bad transaction. Getting this right is the first step to building a real defense for your store.

Think of fraud protection as the security guard standing at your front door. Its entire job is proactive. It uses tools—like Shopify’s built-in analysis or third-party apps—to scan orders as they come in, looking for red flags. The goal is to spot and block a criminal with a stolen credit card before the sale ever goes through. It’s all about prevention.

Chargeback protection, on the other hand, is the legal team you call after something has already gone wrong. It’s a reactive measure for when a customer has already disputed a charge with their bank. These services might help you gather evidence to fight the dispute or, in some cases, offer a financial guarantee that pays you back if you lose a fraudulent chargeback.

In short: Fraud protection stops the crime from happening. Chargeback protection helps you clean up the mess and get your money back. You need both.

For a much deeper look, check out our complete guide on fraud protection for Shopify.

Does Shopify Protect Cover All Chargebacks

This is a huge point of confusion, and the answer is a hard no. Shopify Protect is a great feature, but its coverage is incredibly narrow. It only applies to one specific type of dispute.

Shopify Protect is available for eligible U.S. merchants using Shopify Payments, and it only reimburses you for chargebacks filed for one reason: fraud. If an order is covered by the service and the bank agrees it was fraud, Shopify will refund you the order cost and the chargeback fee.

That’s it. It provides zero help for all the other common reasons customers file chargebacks, such as:

- Product Not Received: The customer swears the package never showed up.

- Product Not as Described: The item wasn’t what they expected.

- Subscription Canceled: They believe they canceled a recurring order but were charged anyway.

- Unrecognized Transaction: They don’t recognize your store name on their bank statement.

For any of those, you’re completely on your own. You either eat the loss or go through the painful process of fighting it yourself.

How Much Does A Chargeback Really Cost

The financial hit from a single chargeback is way more than just the price of the product. New merchants almost always underestimate the true cost, which is a painful stack of lost revenue and fees you can't get back.

Let's do the math on a disputed $100 order to see how a good sale turns into a bad loss, fast.

1. The Lost Revenue ($100):** The first thing that happens is the customer's bank yanks the full **$100 right out of your account. It's gone.

2. The Non-Refundable Transaction Fee (Approx. $3.20): You know that processing fee you paid to Shopify Payments (like 2.9% + 30¢)? You don't get that back. Ever.

3. The Chargeback Penalty Fee ($15):** To add insult to injury, Shopify hits you with a separate penalty fee just for receiving a chargeback. In the U.S., this is **$15, and you have to pay it whether you win or lose the dispute.

So, that single $100** chargeback actually costs your business **$118.20. You're out the product, you're out the revenue, and you've paid extra fees for the privilege. This is exactly why a solid shopify chargeback protection strategy isn't a "nice-to-have"—it's essential.

Ready to stop losing money to fraudulent orders and time-consuming manual reviews? Fraud Falcon offers powerful, automated fraud prevention tailored for your Shopify store. Set custom rules, block bad actors, and get back to growing your business with confidence. Start your 14-day free trial today!