Think of your fraud prevention strategy like a digital immune system for your Shopify store. A basic firewall might stop a common cold, but a truly resilient system needs layers of defense—from automated reflexes to intelligent, adaptive responses—to fight off the nasty, evolving threats that are out there.

Why You Can't Afford to Ignore Fraud Prevention

Picture this: you wake up, grab your coffee, and check your Shopify dashboard, only to find a string of fraudulent orders has completely wiped out your profits overnight. It's not a scare tactic; it’s a very real nightmare for countless Shopify store owners. A solid fraud prevention plan isn't some enterprise-level luxury anymore—it's a basic cost of doing business and essential for survival on the Shopify platform.

Today's ecommerce fraud is a whole lot sneakier than just stolen credit cards. The threats are more complex, more damaging, and aimed directly at your bottom line. These aren't clumsy attempts; they're sophisticated schemes designed to fly under the radar unless you have the right systems in place.

The Ever-Changing Face of Online Fraud

The numbers here are genuinely staggering. By 2025, global ecommerce fraud is projected to drain businesses of around $48 billion a year. That’s a massive threat that every Shopify seller needs to take seriously. A huge chunk of this is something called 'friendly fraud,' which makes up about 18% of all fraud disputes. This is when a legitimate customer buys something and then dishonestly disputes the charge with their bank.

On top of that, fraudsters are getting smarter, using AI-powered tools and automated bots to find and exploit weaknesses in online payment systems. We’re not in Kansas anymore. You can dig into the full research about these emerging threats to get a better sense of just how big this problem has become.

Think of fraud prevention as your store's digital immune system. A simple firewall might stop common viruses, but a robust immune system needs multiple layers—from automated defenses to intelligent responses—to fight off new and evolving threats effectively.

The Big Threats for Shopify Merchants

If you're running a Shopify store, a few specific types of fraud should be high on your radar. Getting to know them is the first step in building a defense that actually works.

- Chargeback Fraud: This is the classic "friendly fraud." A customer buys a new pair of sneakers from your Shopify store, receives them, and then calls their bank to claim they never authorized the purchase. It’s a dishonest way to get a free product, and it hits you directly.

- Return Abuse: This one is all about exploiting your goodwill. For example, a customer might buy a high-end jacket, wear it for a weekend, and then return it for a full refund. Others might return an empty box or swap the new product with an old, used one.

- Account Takeover (ATO): This is when a fraudster gets their hands on a real customer's login details for their account on your Shopify store. They'll log in, change the shipping address, and place orders using the saved payment info, leaving both you and your loyal customer to clean up the mess.

Here’s the thing: every fraudulent transaction costs you far more than just the lost product. You're also out the shipping costs and transaction fees. But the real danger is the chargebacks. Rack up too many, and payment processors like Shopify Payments will start to see you as a risky merchant. That can lead to them holding your funds or, in a worst-case scenario, shutting down your payment processing account entirely.

Using Shopify's Built-In Fraud Analysis Tools

Your Shopify dashboard is more than just a place to manage products and track sales—it's your command center for fraud prevention. Right out of the box, Shopify gives you a powerful, built-in fraud analysis system that serves as your first line of defense. Knowing how to read its signals and act on them is one of the most important skills you can develop as a store owner.

Think of this system as a traffic light for every order that comes in. It uses smart algorithms to size up the risk and gives you a simple, color-coded summary. Getting a handle on these indicators is the first step toward proactively stopping fraud instead of just reacting to it.

Decoding the Shopify Fraud Risk Levels

When you open an order in your Shopify admin, the fraud analysis is right there, giving you an instant gut check on its legitimacy. Each color points to a different level of risk and hints at what you should do next. This isn't just data; it's a clear call to action.

- Green (Low Risk): These are the orders you can generally fulfill with confidence. The system didn't spot any major red flags, and all the payment details look consistent. For example, the billing and shipping addresses match, and the IP address is in the same city. While no system is 100% foolproof, green-flagged orders are usually good to go without a second thought.

- Amber (Medium Risk): This is your yellow light—proceed with caution. Shopify has picked up on a few inconsistencies that are worth a closer look. For instance, the CVV code might have failed, but the AVS check passed. It doesn't automatically mean the order is a scam, but it's a signal to pause and do a quick manual review before you ship anything.

- Red (High Risk): This is a hard stop. A red flag means there's a very high chance the order is fraudulent. An example would be an order where the billing address is in the US, the shipping address is in Nigeria, and the order was placed from an IP address in Vietnam. These orders almost always have multiple, serious warning signs and should be canceled immediately to avoid a guaranteed chargeback.

Here’s a look at what the fraud analysis section looks like on a typical Shopify order page, pointing out the key indicators.

This screenshot shows some of the most critical checks, like whether the card's security code (CVV) and the billing address zip code (AVS) matched the details the customer's bank has on file.

To help you turn these risk levels into concrete actions, here’s a quick reference table.

Shopify Fraud Risk Indicators and Recommended Actions

This quick-reference guide helps Shopify merchants translate risk levels into immediate, practical steps to secure their store.

| Risk Level | What It Means | Immediate Action for Merchant |

|---|---|---|

Green (Low) | The order has passed all major checks and appears legitimate. | Fulfill the order as usual. No extra steps are needed. |

Amber (Medium) | Some details don't quite add up (e.g., AVS/CVV mismatch, odd IP location). | Pause fulfillment. Manually review the order details. Contact the customer if necessary to verify. |

Red (High) | Multiple serious red flags have been detected, indicating a likely fraudulent transaction. | Do not fulfill. Cancel and refund the order immediately to prevent a chargeback. |

By following these simple guidelines, you can make quick, confident decisions that protect your bottom line.

Interpreting the Key Fraud Indicators

Beyond the simple color code, Shopify gives you the details behind its recommendation. Digging into these is what separates the pros from the rookies, especially when you're dealing with those tricky amber, medium-risk orders.

The goal isn't just to spot fraud; it's to confidently approve legitimate orders that might look suspicious at first glance. Being too cautious costs you real sales, but being too relaxed leads to painful chargebacks.

Here are the most important indicators to check in your Shopify order details:

- AVS (Address Verification System) Check: This check compares the numbers in the customer's billing address and zip code to what the bank has on file. A mismatch is a classic red flag. For instance, if the billing address is in California but the shipping address is in Florida, it's worth a second look.

- CVV Check: The Card Verification Value is that little three or four-digit code on the back of a credit card. A failed CVV check means the customer typed it in wrong. It could be an honest mistake, but it's also a strong sign that the person placing the order doesn't actually have the physical card.

- IP Address Geolocation: This tells you where in the world the order was placed from. An order placed from an IP address in one country while the shipping and billing are in a completely different one is highly suspicious.

You can get a deeper understanding of how these signals work together by checking out these insights on protecting your store with Shopify Payments fraud protection.

When you combine the overall risk level with these specific data points, you start to see the full picture. An amber-risk order with a failed CVV and a cross-country IP address is far more likely to be fraud than one with just a minor AVS mismatch. This approach empowers you to make smart, swift decisions that keep your revenue safe.

Building Your Automated Fraud Prevention Rules

Let's be honest, manually reviewing every single suspicious order just doesn't scale. If you're growing, you can't be a detective for every transaction. The real goal is to shift from reacting to threats one by one to proactively building a security net that catches fraudsters 24/7. It’s time to stop chasing bad orders and start architecting a system to block them from the get-go.

Fortunately, if you're on Shopify, you already have some great tools to work with. Shopify Flow, which is available for stores on the Shopify, Advanced, and Plus plans, is a fantastic starting point for workflow automation. For those who need more firepower, dedicated Shopify apps like Signifyd or our own Fraud Falcon offer much deeper, more specialized rule-building features.

Starting with Simple, High-Impact Rules

You don't need to build a fortress overnight. The best way to begin is by setting up a few simple rules that target the most obvious, common signs of fraud. Think of these as your first line of defense—a coarse filter designed to catch the most blatant attempts and free you up to focus on the tricky, more nuanced cases.

Here are a couple of foundational rules you can set up right now using a Shopify app like Fraud Falcon or a Shopify Flow workflow:

- Rule 1 - Cancel High-Risk Orders Instantly: This one is non-negotiable. If Shopify’s own analysis flags an order as "High Risk," it's almost a guaranteed chargeback waiting to happen. Nipping it in the bud is the only sane response.

- Trigger: Order risk is analyzed.

- Condition: If

Order risk level=High. - Action:

Cancel orderandRestock items.

- Rule 2 - Flag International Mismatches: This is a classic fraud signal. When the billing country and the shipping country don't match, it’s a big red flag that something is off. This rule simply tags the order so you know to give it a closer look.

- Trigger: Order is created.

- Condition: If

Shipping address countrydoes not equalBilling address country. - Action:

Add order tag"Review - Geo Mismatch".

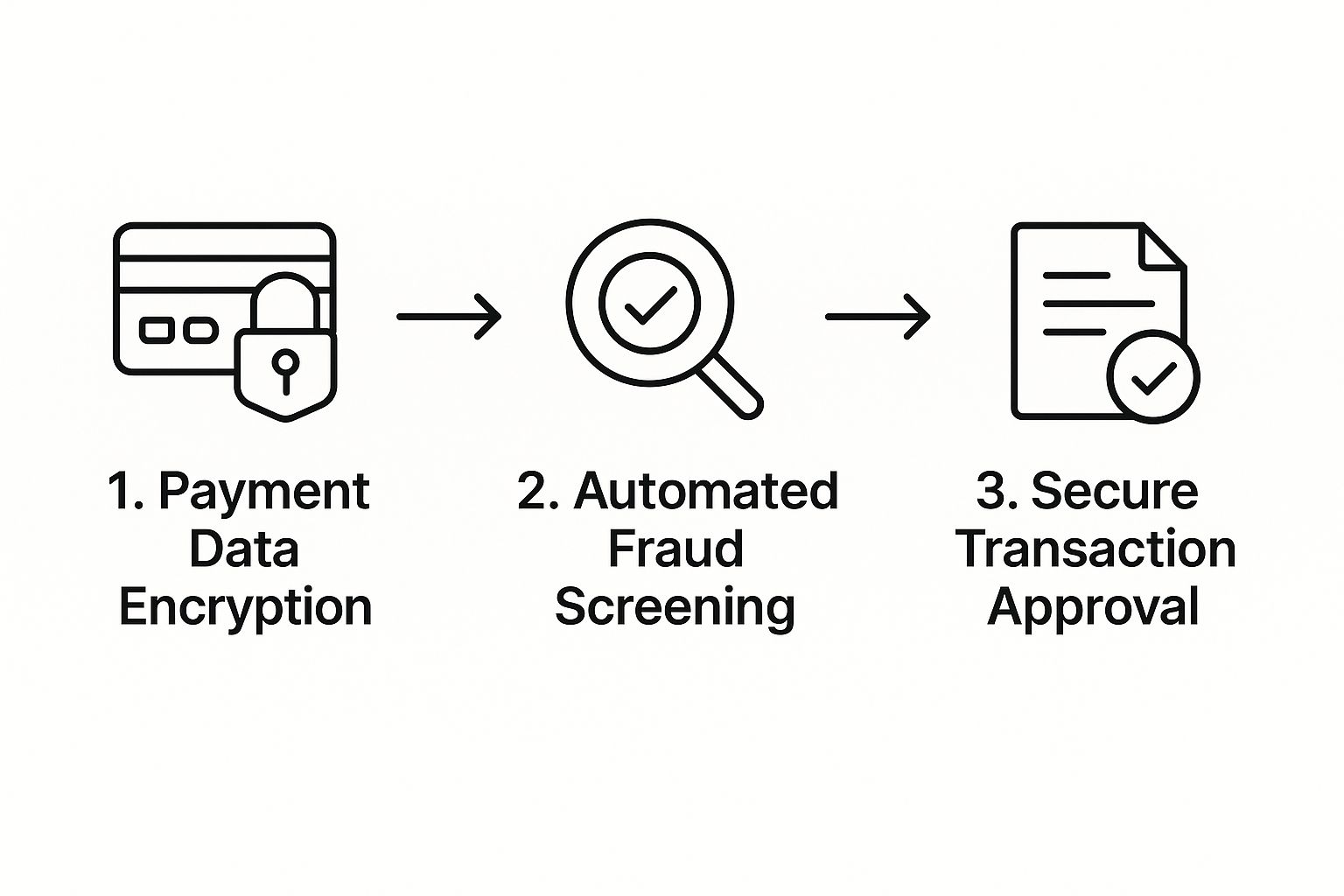

Automated screening isn't just an add-on; it's a core part of the transaction lifecycle.

As you can see, this screening happens right after payment is secured but before the transaction is fully approved. It's the critical checkpoint that protects your bottom line.

Creating More Advanced Workflows

Once your basic rules are humming along, you can start layering in more sophisticated logic. This is where you can really tailor your defenses to your store's specific weak points, products, and customer patterns. The goal is to build workflows that spot the unique fingerprints of the fraudsters who target you.

The cost of doing nothing is staggering. A 2025 study revealed that for every $1 lost to fraud**, U.S. merchants actually lose **$4.61 when you factor in all the associated costs like chargeback fees and operational headaches. With over 53% of fraud losses coming from digital channels, the financial case for automation is crystal clear. Yet, a surprising 41% of merchants still rely on manual reviews, leaving their doors wide open.

Let's build on our earlier examples with some smarter, multi-layered conditions within Shopify.

Pro Tip: Combine multiple conditions using "AND" logic in your Shopify Flow or fraud app. A single red flag could be an honest mistake. Three red flags at once? That’s almost certainly a fraudster. This is the key to creating precise rules that slash false positives.

Check out this more advanced workflow you can build with an app like Fraud Falcon. It’s designed to catch a fraudster who is trying to hide their location while using what is likely a stolen credit card:

- Trigger: An order is paid for.

- Conditions (ALL must be true):

Shopify risk recommendationcontainsIP address is a known proxy.AVS codeis notY(the address doesn't fully match the card).Order totalis greater than$200.

- Action:

Hold fulfillmentandSend internal email notificationto your fraud team.

See the difference? This rule doesn't just blindly cancel the order. It intelligently pauses it and alerts a human to make the final call. This strikes the perfect balance between airtight security and great customer service.

Digging into concepts like Anti Money Laundering transaction monitoring can also give you a broader perspective on spotting suspicious financial patterns. By creating these kinds of custom defenses, you're not just using a generic tool; you're building a security system perfectly molded to your Shopify store's unique risk profile.

Mastering the Manual Order Review Process

Automated rules are your digital frontline, and they’re fantastic for catching the most obvious threats before they can cause any real trouble. But here’s the thing: the craftiest fraudsters have learned how to slip right through those nets. This is where the irreplaceable value of a skilled human eye comes in.

Mastering the manual review process is all about developing an investigator's mindset. It’s how you confidently approve legitimate orders while stopping sophisticated fraud cold.

Think of your automation like a wide-net fishing operation—it catches a lot, but some of the smaller, faster fish swim right through. A manual review is more like spear fishing. It's precise, it's targeted, and it takes a keen eye to know exactly what you’re looking for. The goal isn’t to second-guess every single order, but to know what to do when your systems flag one for a closer look.

The Investigator's Checklist for Suspicious Orders

When a risky order lands in your Shopify queue, you need a consistent, battle-tested process. If you rush it, you risk making a costly mistake—either approving a fraudulent order and eating the loss, or canceling a legitimate one and alienating a good customer. A methodical approach isn't just a suggestion; it's a core ecommerce fraud prevention best practice.

What you're really looking for are clusters of red flags. A single weird detail might just be a typo, but when you see two or three together, it’s a strong signal that someone is trying to pull a fast one.

Here are a few classic signs to watch for in your Shopify orders:

- Unusually Large First-Time Orders: A brand-new customer dropping an order for ten of your most expensive items, totaling five times your average order value? That should set off immediate alarm bells. Fraudsters want to max out a stolen card before it gets shut down, so they go big.

- A Flurry of Activity: Be very wary of multiple orders placed in a short window from the same "customer," especially if they're using different credit cards but shipping to the same address. This is a classic card testing scheme, where they're checking a list of stolen card numbers to see which ones work.

- Urgency and Expedited Shipping: Fraudsters want their stolen goods yesterday. When you see a huge order for five pairs of limited-edition sneakers paired with a request for the most expensive overnight shipping, that’s a massive red flag. They don't care about the cost because they aren't the one paying the bill.

A single red flag is a question. Multiple red flags in the same order are an answer. Your job during a manual review is to connect the dots and see the story the data is telling you.

Using Public Tools for Verification

Your Shopify dashboard is powerful, but it's not your only tool. A few quick, free online checks can give you a ton of context and help you make the final call without creating a bad experience for a potentially great customer.

Think of yourself as a digital detective. You're just using publicly available clues to see if the story adds up. It only takes a couple of minutes, but it can save you thousands.

- Google Maps Street View: This one is surprisingly effective. Just pop the shipping address from the Shopify order into Google Maps. Does it point to a normal house, an apartment, or something weird like a known freight forwarder or a mail drop? An order for $2,000 worth of electronics shipping to a generic warehouse in a port city is highly suspicious.

- Social Media and Search Engines: Do a quick search for the customer's name and email from the order details. Do they have a social media profile that looks like a real person lives behind it? Or is the email a jumble of random characters like

f82k9e9@gmail.com? A complete lack of a digital footprint isn't proof of fraud on its own, but it's another piece of the puzzle. - Reverse Phone Number Lookup: Use a free online service to check the phone number provided in the order. Does it match the customer's name and billing location? Is it a disposable VoIP number? Any mismatch here just adds another layer of doubt.

Here's a simple checklist you can follow every time you perform a manual review. Having a consistent process ensures you don't miss any obvious clues.

Manual Order Review Checklist for Shopify Merchants

| Check Point | What to Look For | Fraud Indicator Level (Low/Medium/High) |

|---|---|---|

IP Location vs. Billing Address | Does the IP address location (country/state) match the billing address? | High |

Billing vs. Shipping Address | Are the billing and shipping addresses completely different, especially in different states or countries? | Medium |

Order Size | Is the order value significantly higher than your average order value (AOV)? | High |

Email Address | Does the email look fake (e.g., asdfg123@email.com) or use a disposable domain? | Medium |

Shipping Method | Did the customer choose the most expensive, expedited shipping option for a large order? | High |

Google Maps Check | Does the shipping address point to a freight forwarder, mail drop, or an abandoned lot? | High |

Customer History | Is this a first-time customer placing an unusually large order? | Medium |

Time of Day | Was the order placed at an odd hour, like 3 AM local time for the customer? | Low |

This checklist helps you quickly assess the risk level by combining multiple data points. A single "High" indicator is cause for concern; two or three together is a strong sign of fraud.

By combining the risk analysis from Shopify with these simple external checks, you build a complete picture of the order. This empowers you to move beyond just following rules and start making informed, confident judgment calls that protect your bottom line.

How to Effectively Manage Chargebacks and Returns

Even with the sharpest automated rules and a seasoned manual review process, some fraud will eventually slip through the cracks. It’s just the nature of the game.

When it does, it usually shows up as a chargeback or an abusive return—two silent killers that can bleed your profits dry if you let them. Nailing your post-purchase process is just as crucial as stopping fraud at the checkout.

Think of this as the final, frustrating stage of a fraud attempt. Winning here takes a different set of skills: meticulous documentation, clear communication, and a process you stick to no matter what. It’s not about winning one dispute; it’s about building a reputation that tells fraudsters you’re not an easy target.

Your Playbook for Winning Shopify Chargeback Disputes

The moment a customer files a chargeback, their bank yanks the funds right out of your account. Now, the burden of proof is on you to prove the transaction was legitimate. Shopify gives you a straightforward way to submit your evidence through the admin, but winning comes down to the quality of that evidence.

You need to put on your detective hat and gather undeniable proof. Your response should be a clean, compelling package that leaves no room for doubt. For example, for an order shipped to Miami:

- Proof of Delivery: This is your silver bullet. Always, always use tracked shipping. A screenshot of the FedEx tracking page showing "Delivered" with a signature at the correct Miami address is the most powerful evidence you can provide.

- Customer Communication: Did the customer email you asking "Where's my order?" and you replied with the tracking number? Screenshot that conversation. It shows they were aware of the shipment.

- Initial Fraud Analysis: Don't forget to include the original Shopify fraud analysis report for the order. If it was flagged as low-risk (green), it shows you did your homework and strengthens your case.

Submitting a well-organized response signals to the bank that you're a diligent merchant, which can make a huge difference in your win rate over time. For a deeper dive, you can read our comprehensive guide on how to reduce chargebacks.

Combating the Rise of Return Fraud

Return abuse has exploded recently. This is where customers take advantage of generous return policies by sending back used items, empty boxes (the classic “box-in-a-box” scam), or falsely claiming the item never arrived in the first place. The financial hit from this is no joke.

Fraud tactics are constantly changing, and we're seeing annual fraud pressure climb by 13% in value. Abusive returns are a massive piece of this puzzle, contributing to what’s estimated as an $890 billion global problem. In fact, between early 2024 and mid-2025, abusive returns shot up by a staggering 64%. It's a clear signal of where fraudsters are focusing their efforts. You can dig into more of these ecommerce fraud and returns trends on Signifyd.com.

A crystal-clear return policy is your shield against abuse. It sets unambiguous expectations for legitimate customers and provides the documentation you need to deny fraudulent claims. Vague policies are an open invitation for exploitation.

To protect your Shopify store, you need a defense that’s just as crafty as the scammers. Here’s how to start:

- Implement a Clear Return Policy: Make it easy to find on your Shopify site and impossible to misinterpret. Spell out the return window (e.g., "30 days from delivery"), the required condition of the item (e.g., "unworn with original tags attached"), and who pays for return shipping. Leave no gray areas.

- Require Photographic Evidence: If a customer claims an item arrived damaged, ask for clear photos of the product and its packaging right away. This simple step helps filter out bogus claims and gives you a record to work with. For instance, you could use a Shopify app that integrates photo uploads into your return process.

- Use Tracked Shipping for Returns: Insist that every return is sent back with a tracking number, which you can manage through Shopify's return labels feature. This shuts down the common scam where a customer claims they shipped the item back when it never left their house.

Putting these simple measures in place creates just enough friction to deter fraudsters while keeping things smooth and fair for your honest customers.

Developing a Long-Term Shopify Security Strategy

Winning the fight against fraud isn’t a one-and-done deal. It's a constant game of cat and mouse. Think of the rules and manual reviews you've set up as your starting line, not the finish line. A truly solid strategy is one that learns, adapts, and gets smarter over time—always staying one step ahead of the bad guys.

This means you have to move beyond just reacting to bad orders as they pop up. The real goal is to build a security system that’s both proactive and intelligent, using the data your Shopify store generates every single day to refine your defenses.

Key Metrics to Monitor in Shopify

So, how do you know if your plan is actually working? You have to track the right numbers. Your Shopify analytics and your fraud app’s dashboard are treasure troves of information, but you don't need to watch everything. Just focus on a few key metrics to see what’s working and where you might have a blind spot.

- Chargeback Rate: This is your big one, the ultimate health check for your fraud prevention. It's the percentage of your transactions that end up as a chargeback. You can calculate this by dividing the number of chargebacks in a month by the total number of orders that month. You're aiming for a consistently low number here—ideally under 0.5%. A low rate is a clear sign your efforts are paying off.

- Manual Review Rate: This tells you what percentage of your orders get flagged by your rules for a manual review. If this number creeps up too high, it's a red flag that your rules might be too tight, bogging down your team with unnecessary work reviewing perfectly good orders.

- False Positive Rate: This is the metric for how many good, legitimate orders you accidentally reject. A high rate here is painful because it means you're turning away real customers and leaving money on the table. It's a signal that your rules need to be fine-tuned for better accuracy.

A great long-term strategy isn't about blocking every possible threat—it's about achieving the perfect balance. You want robust security that stops fraudsters without creating friction for your genuine, loyal customers.

The Cycle of Auditing and Refining

Fraudsters are always cooking up new schemes, so your defenses can't afford to get stale. Make it a habit to do a security audit every quarter. This is your dedicated time to look at your rules in Shopify Flow or your fraud app, dig into any recent chargebacks, and see if new fraud patterns are emerging.

During your audit, ask yourself a few tough questions:

- Are there new fraud patterns slipping through that my current rules are missing? For example, are you seeing a new trend of small orders shipping to a specific freight forwarder?

- Can I make any of my rules more specific to cut down on false positives? Could you adjust a rule to only flag international mismatches on orders over $100 instead of all of them?

- Are there new features in my fraud app (like Fraud Falcon) that I’m not using yet?

This loop of reviewing and improving is what builds a truly durable security setup. A solid long-term strategy also has to think about the bigger picture, like incorporating modern data breach prevention to safeguard all that sensitive customer data you're holding.

By staying on top of things and constantly tweaking your approach, you build a resilient business that's ready for the long haul. To get even deeper into building a powerful defense system right inside Shopify, check out our complete guide on https://fraudfalcon.app/blog/fraud-protection-shopify.

Shopify Fraud Prevention FAQs

Diving into fraud prevention often brings up a ton of questions. As you start putting these best practices into place, you're bound to run into some unique scenarios. Here are some quick, straight-to-the-point answers to the questions we hear most from Shopify merchants.

Does Shopify Protect Me from Fraud?

Yes, to a point. Every single order that comes through your store gets a once-over from Shopify's built-in fraud analysis. This system is great at flagging the most obvious fraud attempts, giving you a baseline level of protection right out of the box by marking orders as low, medium, or high risk.

But think of this as just the first line of defense. Shopify's native tools won't catch everything, and they aren't a complete security system. For real protection that covers your store's specific weak spots, you need to layer on custom rules (using apps or Shopify Flow) and have a solid manual review process.

Should I Always Cancel High-Risk Orders?

Almost always, yes. When Shopify flags an order as "High Risk," it means there are multiple, serious red flags waving. We're talking things like a stolen credit card being used through a proxy server to hide the fraudster's location.

Fulfilling a high-risk order is basically asking for a chargeback. You'll lose the product, eat the shipping costs, and get slapped with a penalty fee from your payment processor.

The risk of losing money on a high-risk order is massive compared to the tiny, tiny chance it’s a legitimate sale. Treat those red flags as a hard stop.

Can I Block a Customer Who Placed a Fraudulent Order?

With a standard Shopify setup, you can't just block a customer by their name or email. This is one of the biggest reasons why merchants turn to a dedicated fraud prevention app.

Tools like Fraud Falcon let you create rules that act as a blocklist. For example, after a confirmed fraudulent order from "John Doe," you can set a rule to automatically cancel any new orders where the customer's name contains "John Doe." This is how you stop repeat offenders from hitting your store over and over again.

What Is the Most Important First Step for a New Shopify Store?

If you're just starting out, the single most important thing you can do is set up a rule that automatically cancels any order Shopify flags as high risk. You can do this with Shopify Flow (on eligible plans) or a fraud app. Think of this simple automation as your 24/7 security guard. It stops the most blatant fraud attempts cold, without you having to lift a finger.

Building strong cyber security risk management techniques from day one is fundamental to your store's health. Once that auto-cancel rule is running, you can start adding more sophisticated rules and fine-tuning your manual review checklist as you get more order data.

Ready to stop reacting to fraud and start proactively blocking it? Fraud Falcon empowers you to build a powerful, automated defense system tailored to your Shopify store. Set custom rules, automatically cancel high-risk orders, and protect your revenue with confidence. Start your 14-day free trial of Fraud Falcon today and see the difference.